When it comes to saving for the future, the more you can set aside, the better off you’ll be. But just how much should you aim to have in order to set yourself up for a comfortable retirement?

According to David Bach, bestselling author of “The Automatic Millionaire” and “Smart Women Finish Rich,” a simple formula can help you determine how much you should have in retirement savings at every age.

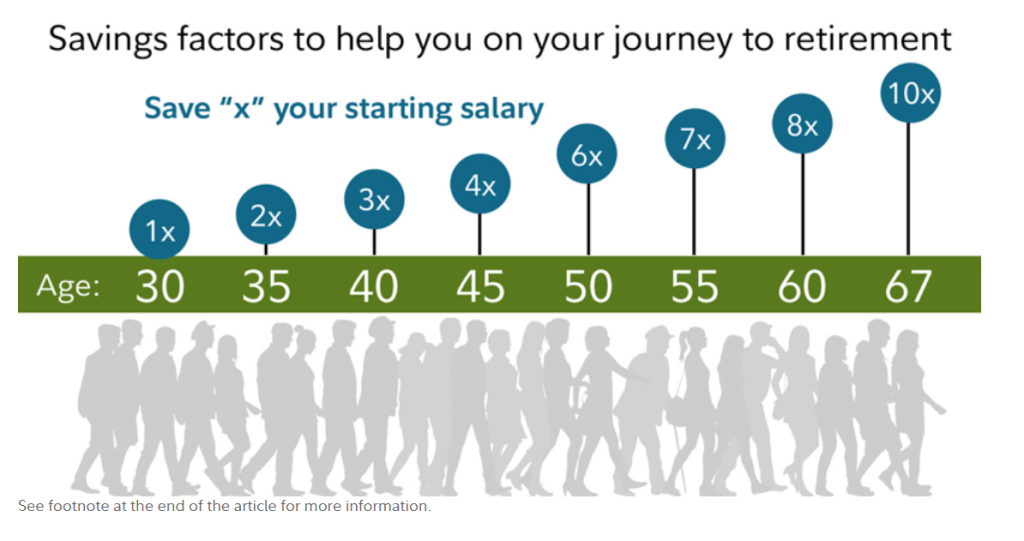

The formula comes from retirement-plan provider Fidelity, Bach tells CNBC Make It, and is as simple as multiplying your starting salary by a factor of “X,” depending on how old you are:

Chart source: Fidelity

Here’s the breakdown of Fidelity’s formula:

Age 30: Have the equivalent of your starting salary saved

Age 35: Have two times your salary saved

Age 40: Have three times your salary saved

Age 45: Have four times your salary saved

Age 50: Have six times your salary saved

Age 55: Have seven times your salary saved

Age 60: Have eight times your salary saved

Age 67: Have 10 times your salary saved

Keep in mind that while this is a good starting point, “it’s a generic formula,” says Bach. Depending on your lifestyle and how you want your life to look in retirement, “you might need to be saving more than that,” and “you definitely don’t need to be saving less.”

That said, if you don’t have the equivalent of your salary saved by age 30 or three times your salary by 40, don’t panic.

“If you’re looking at these charts and it’s depressing you … here’s what I can tell you: It’s never too late to start investing and the best time to start is now,” says Bach. “We’ve seen many people who look at these charts at 50 and have zero in savings — maybe they’ve gone through a divorce or they’ve lost a job or a business or the recession forced them to take a step back. Well, now you’ve just got to get back up and get going again.”

“IT’S NEVER TOO LATE TO START INVESTING AND THE BEST TIME TO START IS NOW.”

Regardless your age or financial situation, to save more, start by revisiting your 401(k) plan if you have one and “increase what you’re saving by at least 1 or 2 percent,” says Bach. “That will get you back up to these numbers that you want to be at.” Make sure you’re contributing enough to get the full 401(k) match if your company offers one. It’s essentially free money.

Then aim to work your way up to setting aside 10 to 15 percent of your income into a retirement fund, he says.

If you’re one of the many Americans without access to a 401(k), don’t stress, and don’t use that as an excuse to put off saving for retirement. You have plenty of other options, including a traditional, Roth or SEP IRA, a health savings account (HSA) or a normal investment account.

Read up on all of your options, choose an account to fund and start setting aside money for your future today.

add a comment

+ show Comments

- Hide Comments